tax update for tax season 2024 (2024 tax year)

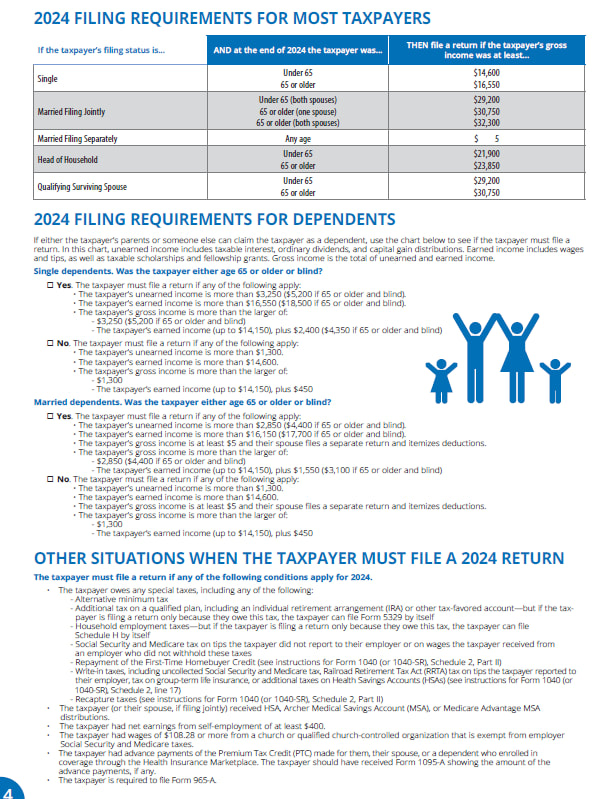

when are tax returns due for year 2024 in 2025?

1065, FTB 565, 1120S FTB 100S any 2 member+ LLC all due 3.15.25

time limit to form 1120S for 2025 3.15.25

individual 1040 FTB 540 4.15.25

C-Corp due 4.15.2025

990 990N non-profit due 5.15.25

C-Corp Fiscal year due 15th day of the 4th month after the close of the tax year

Non-profit fiscal year due 15th day of 5th month after close of tax year

1041 Trust and Estate returns due 4.15.25 Fiscal trust and estate returns due 15th day of 4th month following close of tax year

706 gift tax return due 9 months after decedents death

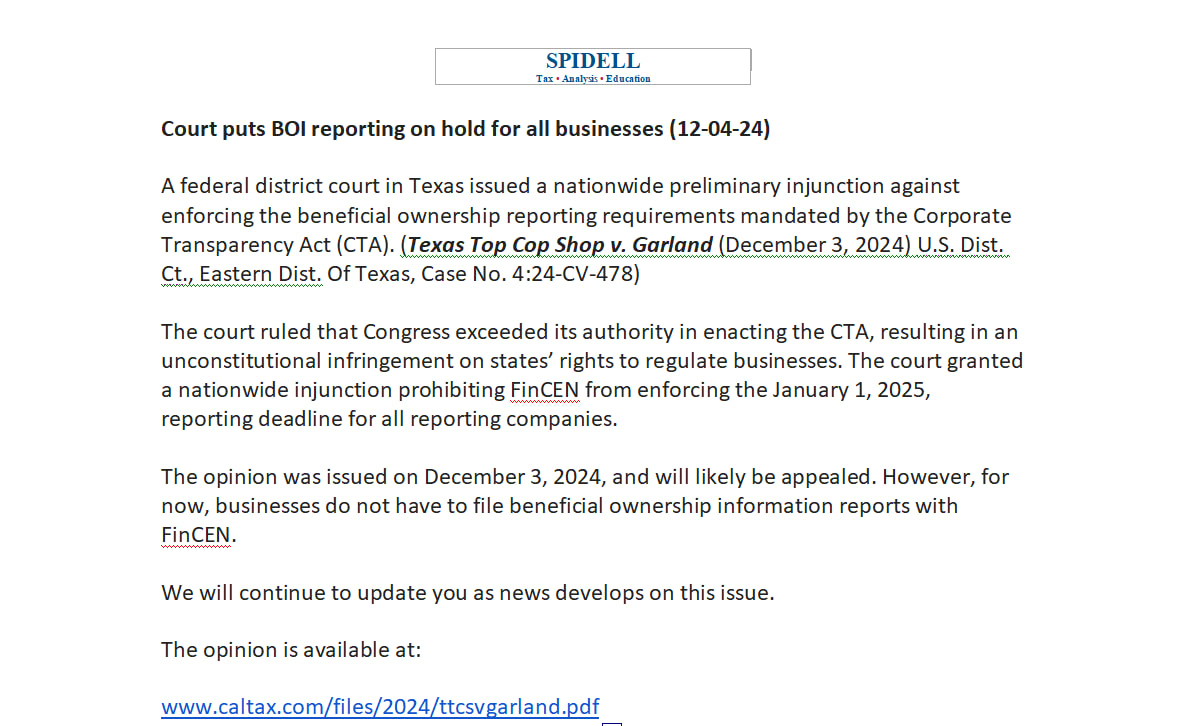

2024 Tax Update: Key Changes and Reminders

The IRS has announced a number of tax changes for the 2024 tax year. Here are some of the most important updates:

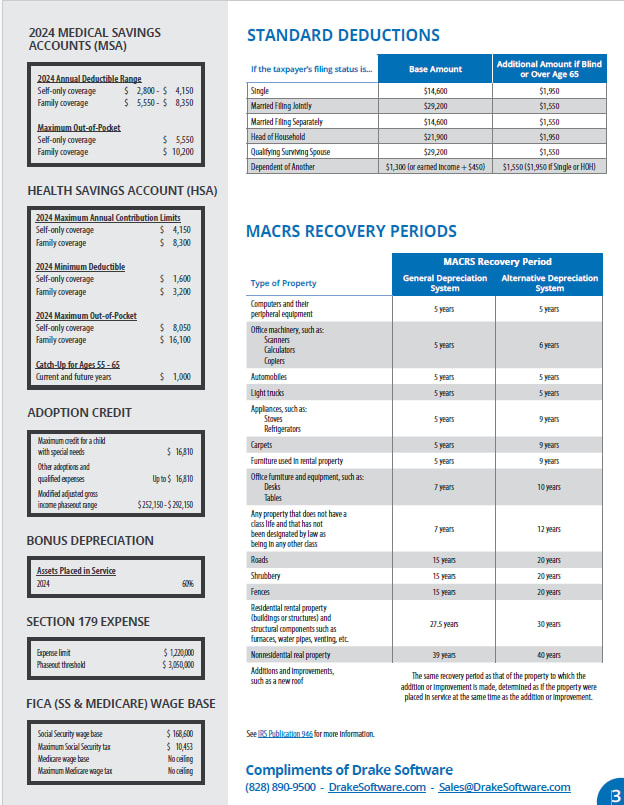

Standard Deduction Increases:

- Married Filing Jointly: $29,200 (up $1,500 from 2023)

- Single Filers: $14,600 (up $750 from 2023)

- Head of Household: $21,900 (up $1,100 from 2023)

- The tax rates themselves remain unchanged, with the top rate at 37%.

- However, the income thresholds for each bracket have been adjusted upwards slightly to account for inflation.

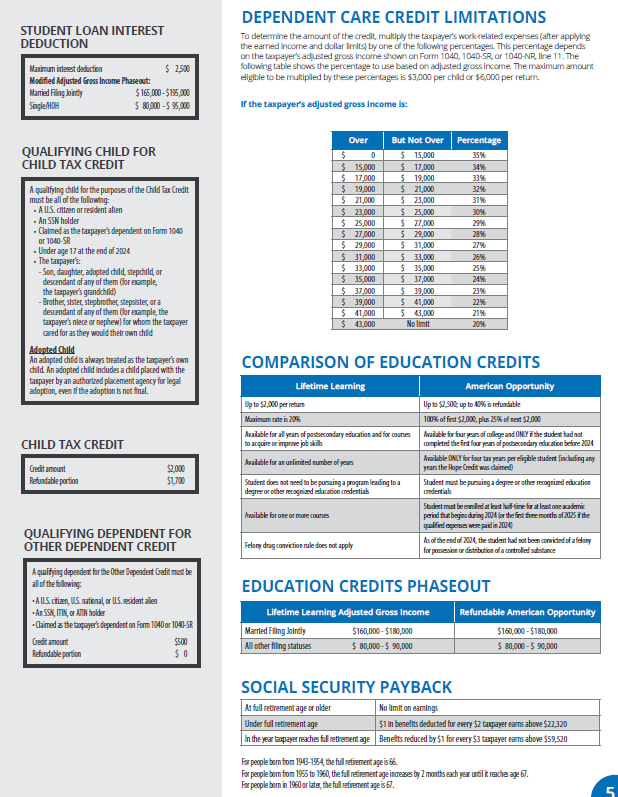

- The 0% capital gains rate now applies to individuals with taxable income up to $47,025 (up from $44,625 in 2023).

- The AMT exemption amount has increased to $85,700 for single filers and $133,300 for married couples filing jointly.

- 401(k) Limit: The contribution limit for 401(k) plans in 2025 will be $23,500, up from $23,000 for 2024.

- IRA Limit: The IRA contribution limit remains at $7,000.

- Qualified Charitable Distributions (QCDs): Eligible IRA owners age 70½ and older can donate up to $105,000 to charity in 2024 through QCDs, up from $100,000.

- Social Security Tax: The maximum earnings subject to Social Security tax increased to $168,600.

- Bonus Depreciation: Businesses can deduct 60% in first-year bonus depreciation, down from 80% in 2023.

- Fringe Benefits: The monthly limit for tax-free qualified transportation and parking fringe benefits increa to $315.

- Tax Day: As of right now, Tax Day is still April 15, 2025, for most taxpayers.

- Filing Electronically: The IRS encourages taxpayers to file electronically and choose direct deposit for refunds to ensure faster processing.

- 1099K for 2024 tax year threshold to recive a 1099k is $5000

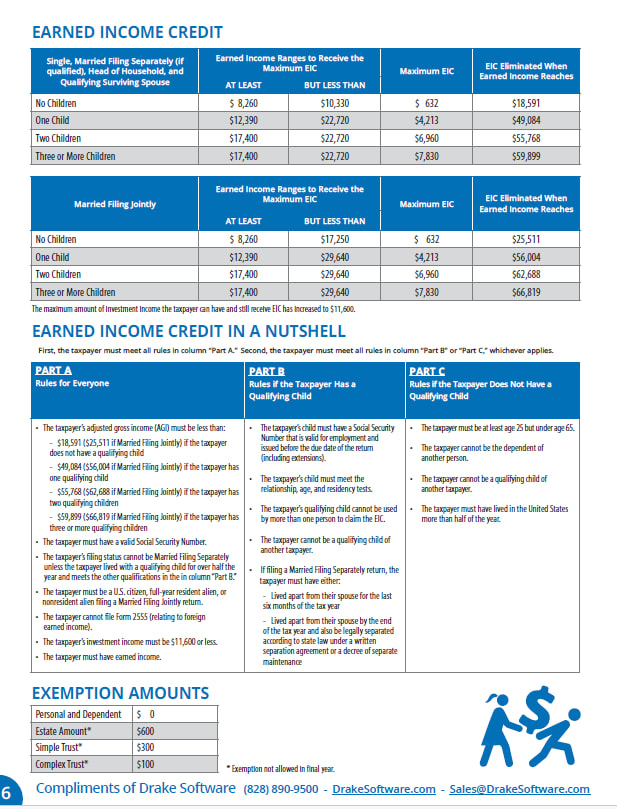

here are the tax numbers for 2024